# Introduction

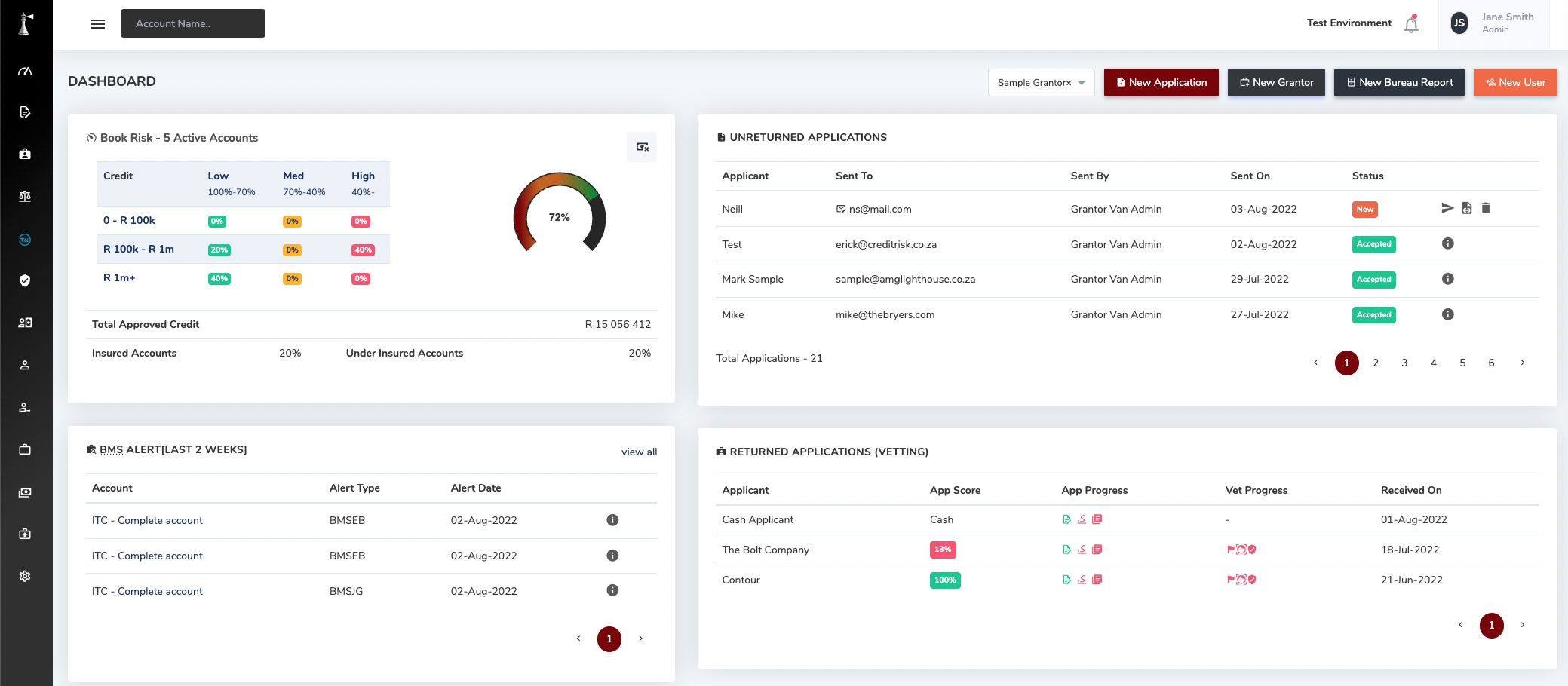

Welcome to CreditRisk Systems (opens new window) documentation and help guides.

The sidebar to the left has all the guides broken down into the different sections of the system. You can also use the search function to find the information you need.

Note:

If you are an applicant trying to fill out a credit application, you can find those guides here.

CreditRisk is a SaaS (Software as a Service). Below you can find a breakdown of the features we offer. If you are looking for more information, please feel free to contact us.

# Digital Onboarding

- Assistance with T&C’s to include relevant legal and regulatory clauses to protect clients.

- Customisation of applications offered.

- Credit application forms with digital signature and document storage centre.

- Ability to provide digital links or QR codes on clients’ websites and other platforms.

- Mobile phone friendly capability, thereby enhancing the effectiveness of the sales team.

# Unique Score Based Credit Vetting

- Guided vetting process to aid in granting of terms to credit and cash customers.

- Customisable scoring values.

- Customisable segregation of duties and limit management.

- Integrated credit bureau reports and monitoring.

- Integrated credit insurance process.

# Book Management

- One-stop solution for age analysis management and debt collection.

- Daily diary with comments, follow-ups and promised payments.

- Ability to view historical age analysis and payment trends.

- Access to total book age analysis and activity reports.

# Pre-legal Collections

- Access to one of the leading, specialist commercial debt recovery and litigation law firms.

- Ability to track follow-ups and payments and view current status of a matter.

- System driven solutions with regular updates and reports.

- Simple legal cost matrix to assist with decision whether to escalate to legal action.